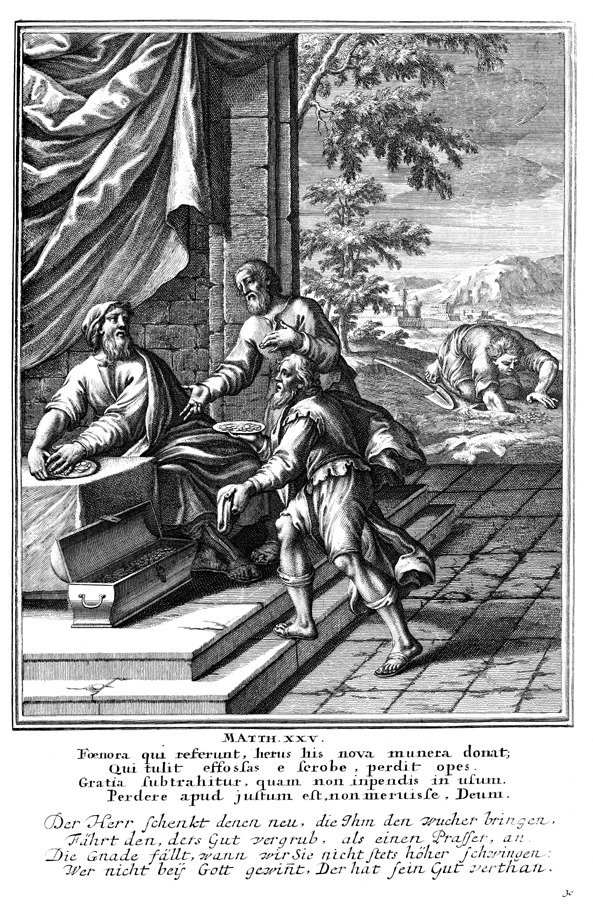

Whoever has will be given more, and he will have an abundance. Whoever does not have, even what he has will be taken away from him – Matthew 13:12

Software is eating the world- Marc Andreessen

- People, Processes and Resources

- Jobs to be done

- Modular vs. Integrated: Low-end disruption theory

_________________________________________________________________

The brilliant above tenants are well-established views that have been driving investment thinking, strategies and theses for several years. I am a massive supporter and proponent of the above and have used them in much of my own thinking. It is on the back of this work that I formed the Disruption Theory of Bifurcation.

Why is it happening?

The first quote by Marc Andreessen, explains it all really. If you want to call it Web 2.0. The rise of mobile, social, search and local, or the 3rd wave of computing…we are living in a world where technology is literally disrupting and innovating every industry. “Software is eating the world”.

Every company and industry, in my view, has therefore suddenly become a technology company whether they know it or not. This changes the game massively. Business models are being upended and reformed and it is leading to massive exciting changes across companies. Given 2 bn people have supercomputers in their pockets, and the next 2 bn are on their way, the reach, scale and access to information are unprecedented!

How is it happening?

Let’s take a simple example to see the bifurcation theory in action. You can really apply this to many industries and I will look to formulate my thinking across various sectors as I bring this theory back in future posts. In most markets, you tend to generally have 3-tiers of services or offerings. In the newspaper or print business, this translated into the free prints, mid-tier priced dailies and then premium offerings. The classification can really be made in exceptional detail based on various types of print media, but for simplicity let’s just take the 3 broad classifications above. Here in the UK you were given a free paper in the morning or evening, had to pay for a more “quality offering” (Telegraph, Times) and pay a premium price for a “premium offering” like the FT.

Along came the web though and placed pressure on this model. The once-profitable industry could now no longer sell as many ads. Consumers were reading their news online which increased the competition and scope of the offerings. You could log on and read from a variety of new sources on demand. Why pay for it? Next came mobile computing however and literally decimated these business models. Now you could read whatever you wanted, whenever and wherever you wanted. Not only did mobile steal eyeballs away from print, but mobile also made the competitive space more competitive than ever. The BBC and Telegraph, with all their journalists and infrastructure (read high variable and fixed costs!), have to compete with every disruptive 1 person blog that attracted millions of users based on a niche subject matter. All of a sudden due to the infinite scalability of software and mobile and social, small upstarts could literally start-up overnight and take on established players. Anyone and everyone (due to the massive online connectedness) has the platform to speak to their 1000 or more true fans on every imaginable niche topic. Ben Thompson of Stratechery (a great example of a successful online blogger and podcaster), wrote a fantastic piece about this and has talked about it on his podcast. I would highly recommend everyone to read and listen to his analogy of the Amazon rainforest.

So what does this mean for the theory? This means that this Middle of the 3 tiered pricing systems, even some of the top end, is being disrupted and dragged down to become commoditised products. Commoditised products mean fierce competition, lower pricing (can’t go much lower than free!), and ultimately lower profits, squeezed business models and failing companies. The middle is being pulled down and hollowed-out and there is a BIFURCATION happening across all industries. Driven by technology! If you offer a real premium, a pay-wall subscription that can still garner interest and attract user attention your fees and business model can withstand this disruption. Although all these publications have had to, no doubt, employ innovative techniques to stay ahead of the game.

If you don’t have that luxury, then guess what, you are now competing on price, readership and attention with any and every online publication, blog and news aggregator, Facebook and Twitter.

How is this happening in the fund management industry?

For years there have been cyclical trends playing in favour of the fund management industry. A future paper will deal with this in more detail. This largely meant an exceptional amount of a) fund management companies were started, b) funds were launched and c) AUM grew. Now though certain, exceptionally strong disruptive forces along with regulation are shaking up the industry. Similar to the newspaper business most fund managers can be classified into 3 buckets…the lowest cost ETFs and tracker funds, medium-priced funds, and the premium services (Boutiques Investment Firms and Hedge Funds) that charged a much higher fee for their offering.

Along comes mobile, and social and search and software and creates disruptive start-ups like Wealthfront and Openfolio which uses software to offer the same service for cheaper compared to a 30-year-old firm with many fund managers, analysts, salespeople and operations (read high variable and fixed costs!). Again, technology (along with regulation in this case) has helped to drive this Bifurcation where the middle and lower end of the premium service is literally being hollowed-out. All fund managers are finding they are having to compete for lower and lower fees with a whole range of products. Fewer and fewer managers can really justify to call themselves “premium” (another interesting trend I’ll touch on in more detail). This ultimately means a shift where the bottom pool gets larger and fiercer, the top-end smaller and more niche and middle no longer can justify their existence. Another great example is the handset business. Premium offerings and ecosystems like the iPhone can thrive whilst the middle tier has competed away and it is a race to the bottom amongst commoditized products charging lower and lower prices. (You are, very interestingly, seeing this play out in society as well, with the middle class being hollowed-out. I’ll maybe touch on this in a future post where I talk about monetary policy.)

So there you have it. Disruptive innovation, driving cheap low-end solutions to compete with incumbents. But through mobile and search and social and the never before seen size of these addressable markets…software is literally creating (eating) every industry! This is causing what I see as a Bifurcation happening across every sector and industry. Everything and everyone has to compete on volume and price whilst a smaller and smaller few can call themselves premium. Those that remain premium have either changed their models or become niche players or have developed or built integrated networks effects that protect them from this. These premium players essentially become stronger and sometimes thrive and prosper even more. It is not necessarily a case of winners take all given the incredible size of the various markets (everyone is more and more connected), but it is definitely a case of winners takes a lot!

However, as Bifurcation theory plays out, being a steady and successful growing business in the “middle”, could, in fact, mean disruption is around the corner!